About vision, mission and those profound issues

Recently we update CIATData information

As usual, the analysis of the new information raises issues for discussion that at times are considered closed. On this occasion, they deal with the vision and mission of seventeen (17) Latin American tax administrations.

As usual, the analysis of the new information raises issues for discussion that at times are considered closed. On this occasion, they deal with the vision and mission of seventeen (17) Latin American tax administrations.

Quite interestingly one observes how the traditional guidelines of the 80’s –to collect so that the State may fulfill its functions, apply the legislation and combat noncompliance– gave way in the 90’s to others which currently do not appear to be so innovative, such as providing taxpayers services and respecting their rights, thereby reflecting the positive impact of the modernization processes undergone by the tax administrations during said decade.

More recently, some, adapting themselves to the new requirements of their environment, have been adopting guidelines to promote tax education (El Salvador and Nicaragua) or actively participate in the international tax field (Chile), and even, formalize the economy (Argentina) or promote competitiveness (Colombia), which matters could be considered outside the sphere of responsibility of a tax administration.

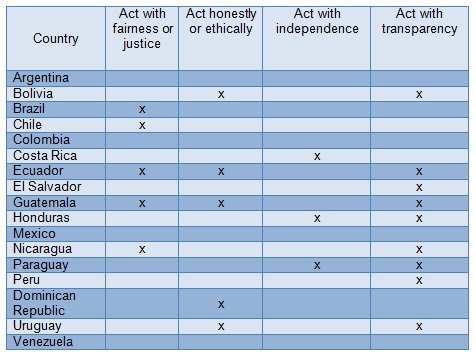

Of particular interest are also those linked to socially accepted values. As may be seen in Chart N° 1, many guidelines currently highlight such aspects as acting with justice, ethics, independence and transparency. In times of democracy and greater citizen participation, it appears to be very important for a tax administration to enjoy high credibility among the citizens, to contribute to achieve the so longed-for social cohesion.

Chart N° 1

Vision, mission and values

According to the CIAT Tax Administration Manual (2000) the vision statement of a collecting entity should reflect its expectations for the future. That is, what it would like to become; while the mission statement should indicate the path to be followed within short term, given its main functions. In a strict sense, this does not in any way differ from what we would say with respect to any other organization.

It was clearly necessary to approach the taxpayer and provide him orientation, assistance and quality services at the lowest possible cost. It is also true that it was necessary to arrive at a better balance between the administrator and the administered. Ultimately, the purpose behind all this is to promote voluntary compliance. But, since we are only five (5) years away from achieving the millennium goals, could it be that our vision and mission statements are lacking some substance?

The term ”collection” or its variants are present in the statements of eight (8) of the countries analyzed, but only in two (2) is it a strongly explicit guideline: to double it in the case of Mexico and constantly increase it in the case of the Dominican Republic.

I assume that my fiscal formation or deformation make me attribute a significant value to collection. Nevertheless, numbers appear to agree with me when we see that, apart from Argentina and Brazil, the Income Taxation from Latin American Central Governments still fail to exceed 20% of GDP. You will also agree with me that there may be a control chart with one hundred indicators, but there is only one which is followed every day by a Minister or Secretary of Finance.

Of course tax administrations struggle every day for increasing collection, regardless of what their vision or mission statements may indicate. However, if what is sought through them is to align the institution’s efforts, it would be worthwhile to review the fundamentals every time there is the opportunity to undergo a planning process.

With respect to combating noncompliance, the term “control” or its variants appears only in the statements of seven (7) of the countries analyzed. A short time ago, I was talking to a top level official from a tax administration in South America and he told me how astonished he was with respect to the resources he had to devote to other than the traditional recovery and examination tasks. The problem is even greater for those tax administrations which, not having achieved their levels of potential collection, have come to assume other governmental functions.

Since no precious vision or mission statement ensures compliance with the institutional objectives, what is really important is to analyze institutional management. Along this line, the CIAT Executive Secretariat with the support of the IDB and CAPTAC-DR for the Central American region, is promoting the Diagnosis of the Tax Administrations of Latin America project, that will allow for determining minimum standards and facilitating international comparison.

Finally, if the intention is for officials to internalize the vision and mission statements, it would be worthwhile to review their extensions. Various planning consultants with whom I have worked have always emphasized the need to use the least possible number of words, if one wishes that they be easily remembered. Only Brazil, Mexico and Nicaragua are following that direction with forty (40) words, in average, for both statements.

2,249 total views, 1 views today