- Featured

- Working Missions

In Montreal, Canada on August 14–16, 2025 CIAT participated in consecutive events that brought together experts, practitioners, and students to discuss the future of tax administration and showcase the next…

- Database

- Featured

The CIAT Executive Secretariat updates information on tax transparency and cooperation in Latin America and the Caribbean on CIATData. With the support of its member countries, the Tax Justice Network…

2,007 total views, 3 views today

- Featured

- Publications

The CIAT Executive Secretariat is pleased to announce that section 5.2 of the Manual for the Control of International Tax Planning, titled “5.2 Mechanisms to identify risks”, is now…

- Featured

- Publications

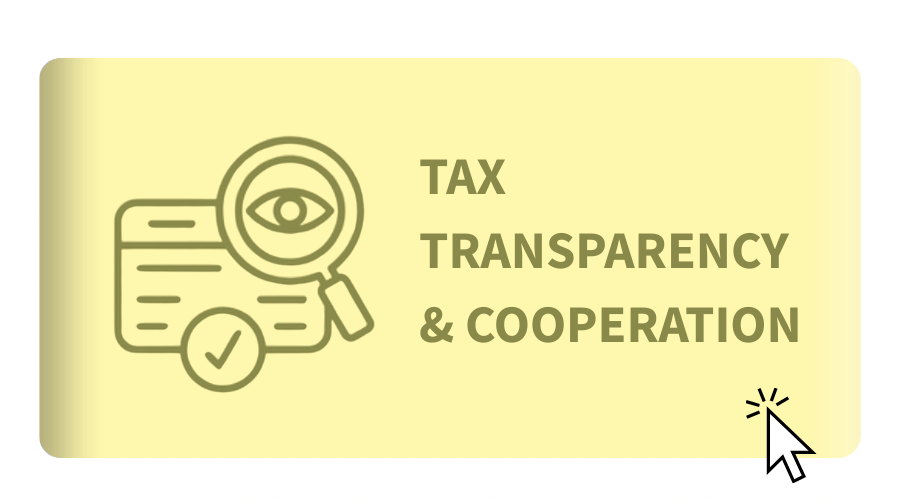

This study examines the opportunities, challenges, and applications of artificial intelligence (AI) in the field of transfer pricing. Through a rigorous and up-to-date analysis, it addresses key topics such as…

1,965 total views, 3 views today

- Featured

- Publications

The Directorate of Tax Studies and Research of CIAT manages and updates the Latin America and Caribbean Tax Expenditures Database based on national reports, reaching the highest possible level of disaggregation.…

1,958 total views, 7 views today

- Featured

- The Executive Secretary in the Press

Conducted with CIAT’s Executive Secretary, Márcio Ferreira Verdi, published in the 5th edition of the Vision and Performance magazine of the Inter-American Accounting Association (AIC). In this edition, Mr. Verdi…