BLOCKCHAIN: Concepts and potential applications in the Tax Area (2/3)

4. PROPOSALS FOR THE TAX ADMINISTRATION PRACTICES: PRESENTATION AND COMMENTS

4.1 Fighting VAT fraud in the European Union[1]

VAT fraud in the European Union (EU) are estimated between € 50 and € 60 billion annually by the MTIC process (Missing Trader Intra-Community).

Basically the MTIC takes place in an intra-Community operation when the purchaser of a product in another country, but does not comply with the rules; he does not makes the reverse charge, does not fill truthfully a VAT statement for the country of the seller and does not submit the caused VAT, but also sells the product to another company in his country charging VAT for the new value of the product. By not referring the VAT in the country of the original seller, this seller becomes a “missing trader”. The tax authority of the missing trader’s country must act fast as this company and/or its owners can leave the country. For that, they need to be quickly informed of the transaction (see details about the MTIC[2]).

In this sense, the European Commission, in its 2016 VAT Action Plan, recommended that Member States need new means of sharing information, so they would identify and dismantle the networks of fraud more rapidly. This year (2017) the EU should introduce a definitive intracommunity VAT system based on the taxation in the destination’s country.

VIES and DICE

The VIES (VAT Information Exchange System) is a computerized system of information exchange on intra-Community transactions between the EU countries. The biggest problem of this system are the too long time periods involved in this exchange, in addition to the fact that the information exchanged is aggregated. The details of an operation must individually be requested (which implies additional time for response).

The times involved are measured in months. In the detection of the fraud, that’s a critical issue.

DICE

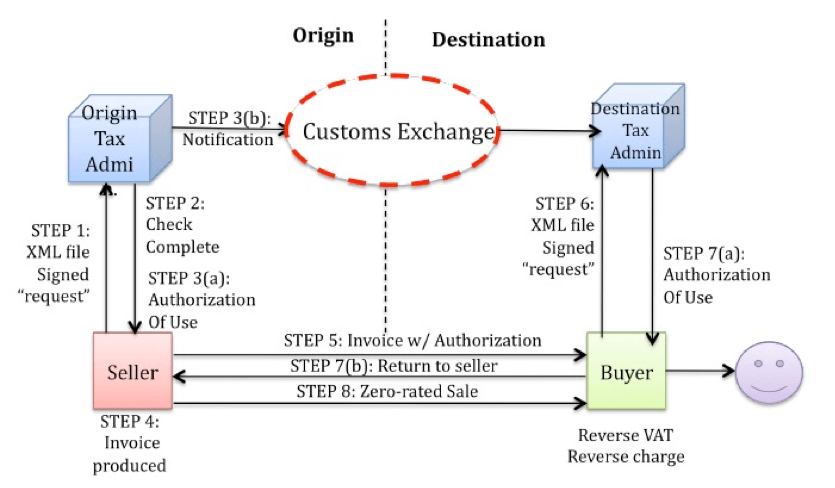

The DICE initiative (Digital Invoice Customs Exchange) represents an attempt to improve the exchange time and the quality of the data. The signed invoices will be exchanged automatically and digitally. In addition, this initiative would be based on the exchange of information between each of the 28 member countries-independent centralized databases, extremely complex task in terms of safety, quality and reliability of the information. The use of DICE is based on the following diagram (Figure 4):

Figure 4: Operating scheme of DICE

Source: Ainsworth and Todorov[3].

The proposal of Ainsworth & Shact to implement DICE in blockchain, as described here under.

Principles of the VAT implementation in blockchain

For implementation of VAT in blockchain, an economic community will need a network of computers, a network protocol and a mechanism of consensus. Each product or service marketed will have its own distributed ledger of transactions, showing the original owner, the intermediaries and the current owner. Each verified transaction of this element will be a block added to the general ledger, which will be connected to the previous blocks, creating a chain of blocks.

This will create a verified record of the property of the VAT. If the nodes of the network do not validate a transaction, a valid VAT claim cannot be issued.

Network computers and Protocol

The network of computers follow the general concept of the blockchain, maintaining an identical copy of the chain of blocks on each node. It may not be a public blockchain, and operators must be indicated by the Governments. Each node will be responsible for validating the proposed transactions and to determine whether the parties involved are probable compliant taxpayers. This determination may be based on Artificial Intelligence, automatic association of data or intervention of auditors.

The authors recommend the adoption of the Sawtooth Lake Intel Protocol[4], which is the contribution of Intel to the Hyper-Ledger project.

Consensus mechanism

There is no universal consensus mechanism: each solution must be established according to the problem to be solved. Thus, in a blockchain for the VAT system, this mechanism must be based on objective criteria that assess the risks of fraud. The Sawtooth Lake Protocol, mentioned above, has practical consensus mechanisms, which can be followed, according to the scheme shown below.

Proposal in process

The basis of the proposal is that both jurisdictions, the seller and the buyer, have an interest in confirming the legitimacy of the transaction.

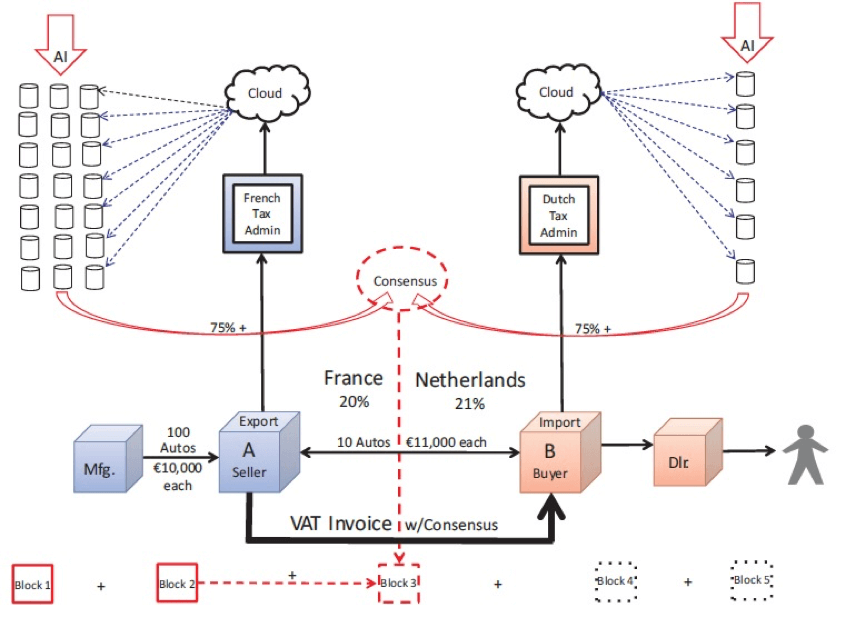

Below, is a practical example (Figure 5).

Figure 5: Scheme of the DICE proposal in blockchain

Source: Ainsworth & Shact

Suppose that a car factory in France produces 100 cars for export which are sold domestically to A for €10,000 each. A agrees with B, in the Netherlands, the sale of 10 cars for €11,000 each. After importation, B sells cars to resellers in Holland, which then sells them to Dutch final consumers.

A distributed general ledger records the materials purchases transactions for the construction of each of the 10 cars (block 1), which are transferred to A (block 2). The cross-border sale for B is the “block 3”. If a consensus is found, the “block 3” is chained to the “block 2” in the same way that the “block 2” was chained to the “block 1”. When A and B agree on the terms of transaction, they must transmit the terms to their respective tax administrations (France and Netherlands).

The agreement will then be disseminated internally by each tax administration for the purposes of assessing the tax risks of the transactions and of each involved taxpayer, to be performed by artificial Intelligence systems.

The artificial intelligence systems oriented to the tax area are available, in practical terms, to carry out the risk analysis. In the Brazilian State of Ceará, a risk evaluation system has been installed (“fiscal intelligence”), in real time, to control the emission of the VAT-related invoices (ICMS)[5].

It is assumed that each specific evaluation is made on an internal network node of a tax administration, for example, assessing if the prices are at market value, if the goods are insured, if taxpayers have good tax record, statistical anomalies, etc.

In the example, it was established that a consensus will be found where at least 75% of the nodes in each Administration agree with the transaction. When this consensus is found, this event will automatically be entered into the general ledger and a fingerprint will be placed on the invoice.

When the transaction is authorized and registered, auditors can follow online its conclusion.

Comments

In a similar way to the original DICE, its implementation in blockchain will not remove the first occurrence of MTIC/MTEC fraud, but detect in real time the efforts of continuity. It will also provide tax administrations with more and better information, online, to block attempts at fraud more quickly.

For its implementation in the terms proposed by Ainsworth & Shact, it will be important to define the contribution in terms of technology that each country will provide to maintain the distributed general ledger.

[1] Ainsworth & Shact, “Blockchain technology may solve VAT fraud”, TaxNotes, vol. 83 #13, sept 26, 2016

[2] https://en.wikipedia.org/wiki/Missing_trader_fraud

[3] Ainsworth & Todorov: Stopping VAT fraud with DICE, Taxes Notes November 18, 2013

[4] https://intelledger.github.io/introduction.html

[5] http://diariodonordeste.verdesmares.com.br/cadernos/negocios/sefaz-vai-adotar-novo-modelo-de-controle-fiscal-1.1091356

5,544 total views, 2 views today

1 comment

Thanks. Enjoy!