BLOCKCHAIN: Concepts and potential applications in the tax area (1/3)

1. BITCOIN: ORIGIN

Presented in 2008 by Satoshi Nakamoto (pseudonym of a person or group of persons not yet identified), the concept of digital currency or cryptocurrency Bitcoin brought the blockchain technology as a support for its implementation.

Without any central control point, Bitcoin utilizes the blockchain technology to connect peer-to-peer (P2P) networks[1], cryptographic algorithms, distributed storage and decentralized mechanisms of consensus. All software is public and available on the Internet.

The user does not need a formal identification: to participate, simply download the software and get a pair of cryptographic keys.

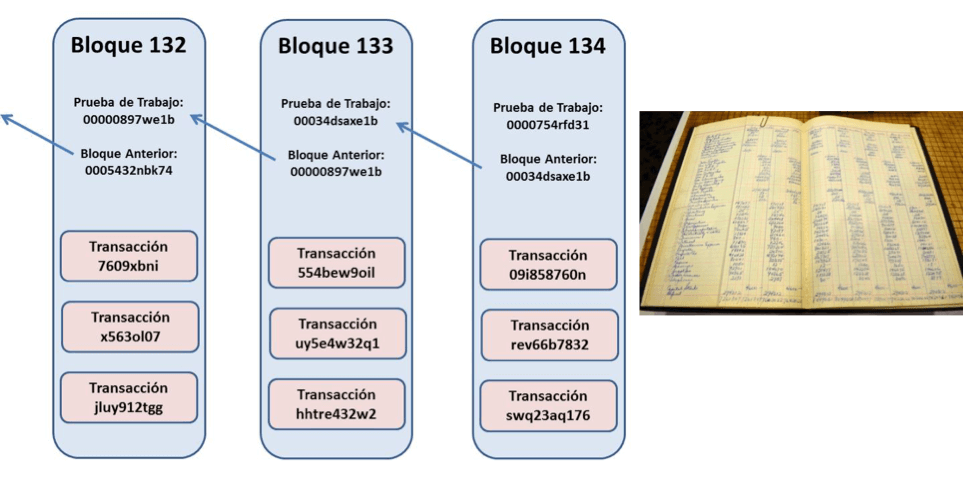

The central idea of the creation of Bitcoin is to facilitate the exchange of money in secure, electronic manner and without the assistance of intermediaries (i.e., banks). It does not depend on the confidence of an issuer or financial institution. Transactions are validated by the nodes of the P2P network and recorded in blocks of a distributed data bank (ledger, general ledger). I.e., each node can locally verify all transactions. Sophisticated algorithms, time-stamps, and cryptographic keys ensure the immutability of the transactions and solve the problem of “double spending”. Transactions generated by the users are spread across all the nodes in the network and grouped in blocks on each node. Each node compete to have their block included in the chain.

To include a block of transactions in the distributed database, a consensus mechanism is activated among the nodes, called “Proof of work” (PoW): the nodes with special abilities, named “miners”, compete in the resolution of a mathematical puzzle based on hash calculations, highly expensive in terms of expenditure of CPU, and by extension, electricity. The winning node has the right to register its block of transactions and in addition get a remuneration in new Bitcoins[2]. The consensus mechanism, in addition, contributes to ensure the security of the network. Transaction blocks are sequentially connected by means of cryptographic mechanisms (blocks string) and are also immutable.

In practical terms, the Bitcoin network calibrates its consensus mechanism to register a transaction block every ten minutes or more. With this latency, the system is suitable for transfer of values, but cannot be used to pay for a coffee at Starbucks…

Other cryptocurrencies, with different mechanisms of consensus, can have much lower latency.

The value of the Bitcoin has varied greatly over time. Currently, many consider it an asset and not a currency. At the end of June of 2017, 1 bitcoin was equivalent to USD 2.600,00.

There are currently more than 700 cryptocurrencies in the world, called altcoins.

Some countries already issued their national cryptocurrencies, such as Tunisia (e-Dinar) and Senegal (eCFA). Other Governments, such as Canada and England, are also planning to adopt their national cryptocurrencies.

For further information about Bitcoin, access: https://bitcoin.org/en/

2. BLOCKCHAIN: HOW IT WORKS

Although it has been created to support a cryptocurrency, the blockchain can be used to sign contracts, documents, properties[3], patents, products, etc. Technology extensions support smart contracts (whose terms are applied automatically and digitally) and other applications.

Likewise, for other applications, its basic structure remains as described above. Essentially, what changes are the consensus mechanisms adopted.

Figure 1 below briefly explains the structure of the general ledger of the Bitcoin:

Figure 1: Scheme of the blockchain

Source: adapted from Rojas, H.[4]

The blockchain can be defined as a public, distributed, ledger that always keeps a growing list of records or transactions, gathered into blocks, which are secure against any revision or adulteration and are fully traceable. Each computer on the network is a node which has an identical copy of the chain of blocks (blockchain). If any node is compromised (hacking, sabotage, hardware failure), all other nodes will keep the integrity of the general ledger.

Blockchain technology components are:

- Private and time-stamping key cryptography

- P2P distributed network

- Shared Data Bank (or ledger) shared

- Mechanism of consensus

- Incentives for participants to process transactions, stored data, and taking care of the security[5]

It is observed that technologies used are known. What stands out is the way how they are integrated, through the mechanism of consensus.

Consensus mechanisms

The consensus mechanism depends on the characteristics of the service: it can be very complex and expensive, such as the one described previously for the Bitcoin (“Proof of work – PoW”) currency, or simpler.

Note that the function of the consensus mechanism is to define which block of transactions will be written in the distributed ledger, which must be unique, as well as prevent opponents to break or damage the blockchain.

Public blockchain services, with unidentified users without any centralized control, require more sophisticated consensus mechanisms.

In addition, other mechanisms of consensus can be used in systems based on blockchain.

One of the best known is the proof of participation (Proof of Stake – PoS): validator nodes or “mining nodes” must invest in currencies of the system (in the Proof of Work, validators invest in computational capacity, as described above). If a validator has invested 300 coins and another has 100, the first will be three times more likely to be chosen validator of a block. Yet the block has to be agreed with other validators to be written to the blockchain string. The compensation of the validators comes from the transactions themselves, i.e., there is not a money “source” as in Bitcoin.

Smart contracts (Smart Contracts)

A smart contract is a computer program that facilitates, ensures, enforces and executes agreements between people and organizations using the blockchain technology. When a pre-programmed condition is triggered, the smart contract executes the corresponding contractual clause. They are intended to provide a security stronger than a traditional contract law and reduce transaction costs associated with contracting. It is said that “the (computer) program is the law”.

They can be implemented in any transaction requiring an agreement registered between parties, as, for example, financial products procurement or insurance, security deposits, trading operations, or management of collateral or financial products.

The origin of smart contracts comes from 1990, but blockchain technology enabled its implementation in a more full and safe way.

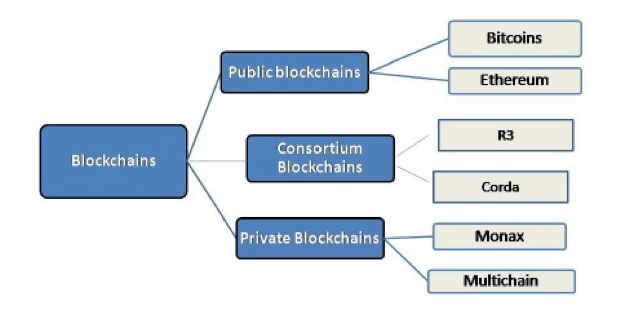

Types of blockchains:

The blockchains can be characterized into 3 types[6]:

2.1 Public blockchain

It is a blockchain where anyone in the world can: read the transactions; forward transactions and expect that they are included in the string of blocks, if they are valid; participate in the consensus process. These blockchains are secured by components of consensus called crypto-economics – a combination of cryptographic checks and economic incentives, i.e. a general principle whereby the degree of influence of a participant in the process of consensus is proportional to the amount of resources that they put into the system (in the case of proof of work it used computational capacity and compensation for each “winner”; in the proof of participation, selection is based on direct financial investment and remuneration for each “winner”, with fines for delays in the preparation of blocks – i.e. They must also invest in computational capacity).

They are completely decentralized blockchains.

2.2 Consortium Blockchain

It is a blockchain where the consensus process is controlled by a set of pre-selected nodes. As an example, you can have a consortium of 15 financial institutions, each operating a node, with the condition that at least 10 institutions need to digitally sign a block so that it is valid.

Rights read blocks, interaction with public blockchains or other rights are defined according to policies established by the consortium.

They are completely decentralized blockchains.

2.3 Blockchain private

It is a blockchain where write permissions are kept centralized in one organization. The read permissions can be public or restricted, on an arbitrary basis: it depends on application and analysis of the Manager.

Figure 2: Types of blockchain

Source: Gupta, A.[7]

Blockchain platforms

There are many platforms for the development and implementation of blockchain systems, each with its own peculiarities.

One of the most ambitious projects in this context is developed by the Linux Foundation, called HYPERLEDGER (www.hyperledger.org). This project presents several business-oriented blockchain technologies and has large traditional companies as members, and other smaller, specialized, as presented in Figure 3.

Figure 3: members of the Hyperledger

Figure 3: members of the Hyperledger

Source: hyperledger.org

See https://letstalkpayments.com/companies-providing-enterprise-grade-blockchain-solutions/ for more detailed information on blockchain platform providers.

3. BLOCKCHAIN IN THE TAX ADMINISTRATION (TA)

The potential of the blockchain technology extrapolate the universe of the cryptocurrencies. Several applications were created, are developing or are evaluated, including in the Government area, such as the registration of properties, citizen’s identification, supply chains, medical records, etc.

In the World economic forum in Davos, in 2016, more than 800 observers and technology executives were questioned about when they thought that the Governments would begin to collect taxes using blockchain. The average responses pointed at 2023, with 73% of responses mentioning 2025[8].

Another topic of interest will be the growing development of the Internet of things – IoT, which many experts believe to be an ideal field to apply blockchain[9]. With billions of smart devices participating in a global network, from fridges and kitchens to cars and boats, we can preview a set of wonderful applications in different areas. But, why not also in the tax area? These devices will go through several changes of status from their manufacture (including change of owner, upgrades, etc.) and some of these changes may be of tax interest.

Tax administrations were already interested in applications of blockchain technology and some actions and studies have taken place, initially associated with the Academy, to identify areas for application in the tax administration. Typically, VAT management and payment were the first designed applications, although at the academic level, as we shall see in the next chapter.

Also, we can think of applications that require the coordination of actions between tax administrations; between administrations and taxpayers; between internal departments of a tax administration. Typically, tax applications will be developed in blockchains of the type consortium or private.

Specialists warn that the blockchain is a potential facilitator, but not the complete solution. The expansion of the digital world and the shared economy will probably force the TAs to seek new legislation, methods and technologies to ensure the collection of taxes. Blockchain would be a potential partner in these efforts. It is admitted that this technology can change the way taxes are collected: the responsibility for collecting the tax on income or sales may possibly shift completely from tax authorities towards the participants of the shared economy[10].

On the other hand, we should consider investments in information systems which, using traditional techniques or even centralized data banks, already perform this type of coordination, such as SINTEGRA (Brazil) and electronic invoicing. In this case, the main aspects to be evaluated are if the availability of information under the blockchain model will be more extensive, fast, secure and reliable, and if it is the case, we should consider the results that these advantages will bring to the process control and collection.

[1] Architecture of computer networks where each one of the points of network works both as client and server, allowing sharing and data services without the need of a central server.

[2] The Bitcoin system has reserves of Bitcoins for compensation of the “miners”. It is estimated that this reserve will be extinguished by 2040.

[3] http://experienceclub.com.br/ucrania-usa-blockchain-em-terras/

[4] https://www.slideshare.net/hedugaro/tecnologia-blockchain-fundamentos-aplicaciones-y-posibilidades.

[5] These incentives can be monetary, as in Bitcoin order, or a legal / regulatory, as in other applications of blockchain.

[6] https://blog.ethereum.org/2015/08/07/on-public-and-private-blockchains/

[7] https://www.linkedin.com/pulse/blockchain-technology-types-components-dr-anita-gupta

[8] https://www.wsj.com/articles/what-blockchain-is-and-what-it-can-do-1466388185

[9] https://www.forbes.com/sites/delltechnologies/2017/06/27/how-blockchain-could-revolutionize-the-internet-of-things/#51436f5f6eab

[10] “How blockchain could improve the tax system”, PWC UK

17,470 total views, 8 views today

2 comments

Additional material that might be reviewed

https://pixelprivacy.com/resources/what-is-the-blockchain/

Thank you.